Postings to the final ledger come from the books of prime entry. For this reason the ledger is usually often identified as the book of ultimate entry or the guide of secondary entry. Uncover comprehensive accounting definitions and practical insights.

- Balancing off accounts is essential to discover out the remaining amount in an account, usually done weekly, month-to-month, or on the end of a trading period.

- If the double entry has been carried out, the total of the debit balances ought to always equal the whole of the credit score balances.

- In order to prepare a trial steadiness, we first want to finish or ‘balance off ’ the ledger accounts.

- Our detailed information on checkbook balancing serves as a straightforward introduction or a helpful refresher, breaking down the essentials into manageable steps.

- To shut that, we debit Service Revenue for the total quantity and credit Earnings Abstract for a similar.

What Are Closing Entries?

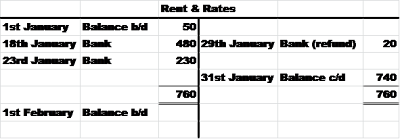

Moreover, it consists of train questions to strengthen understanding of the concepts offered. Balance off is a typical practice in accounting the place the debit and credit sides of an account are totaled, and a stability is inserted to equalize the perimeters on the end of a monetary accounting interval. This is crucial for accurate financial reporting and ensures that the accounts are prepared for the subsequent accounting interval. In a sole proprietorship, a drawing account is maintained to report all withdrawals made by the owner. In a partnership, a drawing account is maintained for each partner. All drawing accounts are closed to the respective capital accounts at the finish of the accounting interval.

To close the drawing account to the capital account, we credit score the drawing account and debit the capital account. The totals from the books of prime entry are posted to the nominal accounts within the nominal ledger by way of double-entry. From the trial steadiness we will see that the total of debit balances equals the total of credit score balances. This demonstrates for every transaction we’ve followed the basic principle of double-entry bookkeeping – ‘ for every debit there is a credit ’.

Browse all Open University programs and begin your journey today.

Empowering students and professionals with clear and concise explanations for a better understanding of monetary phrases. The Earnings Summary stability is ultimately closed to the capital account. A business will wish to know the stability on each account (to add to the Trial Balance). Enrol and full the course for a free statement of participation or digital badge if available. Anyone can learn for free on OpenLearn, but signing-up provides you with entry to your private studying profile and report of achievements that you simply earn while you study.

Balancing Off Accounts Notes Feb 2023

For partnerships, every companions’ capital account might be credited based mostly on the settlement of the partnership (for example, 50% to Partner A, 30% to B, and 20% to C). For companies, Earnings Summary is closed entirely to “Retained Earnings”. Making a listing of the above balances brought down produces a trial steadiness as follows.

A small business will maintain https://www.personal-accounting.org/ all its accounting data using a single common ledger supported by the books of prime entry corresponding to day-books and journals along with accounting supply paperwork. The next step within the general ledger and monetary reporting cycle is to prepare an unadjusted trial balance. Before you get started with checkbook balancing, it is essential to have an excellent grasp of primary check-writing practices and know tips on how to correctly report transactions in your checkbook register. If you’re new to this, we now have introductory classes obtainable in our Checking Accounts and Check Writing Lessons section to assist you perceive the fundamentals.

Nevertheless, some firms use a brief clearing account for dividends declared (let’s use “Dividends”). They’d document declarations by debiting Dividends Payable and crediting Dividends. If this is the case, then this momentary dividends account needs to be closed at the finish of the period to the capital account, Retained Earnings.

It highlights points such as inaccurate financial data, money circulate issues, and difficulties in decision-making that come up balancing off accounts from not maintaining proper account balances. The document also outlines the steps to stability an account, emphasizing the need of correct financial management for efficient enterprise operations. Our detailed guide on checkbook balancing serves as an easy introduction or a useful refresher, breaking down the essentials into manageable steps. In addition to the information, we provide a Checkbook Reconciliation Worksheet designed to streamline the process of reconciling your checkbook along with your monthly bank statement. This worksheet is a dependable device for maintaining correct and present monetary records.

After getting ready the closing entries above, Service Income will now be zero. The expense accounts and withdrawal account will now even be zero. The purpose of closing entries is to arrange the momentary accounts for the next accounting period.